- Adam Neumann and We Holdings sold about $500 million in stock while he was CEO, a new book says.

- Neumann used money from six of eight fundraising rounds for personal reasons, "The Cult of We" says.

- He reportedly had eight homes and so many units in one building that he controlled its condo board.

- See more stories on Insider's business page.

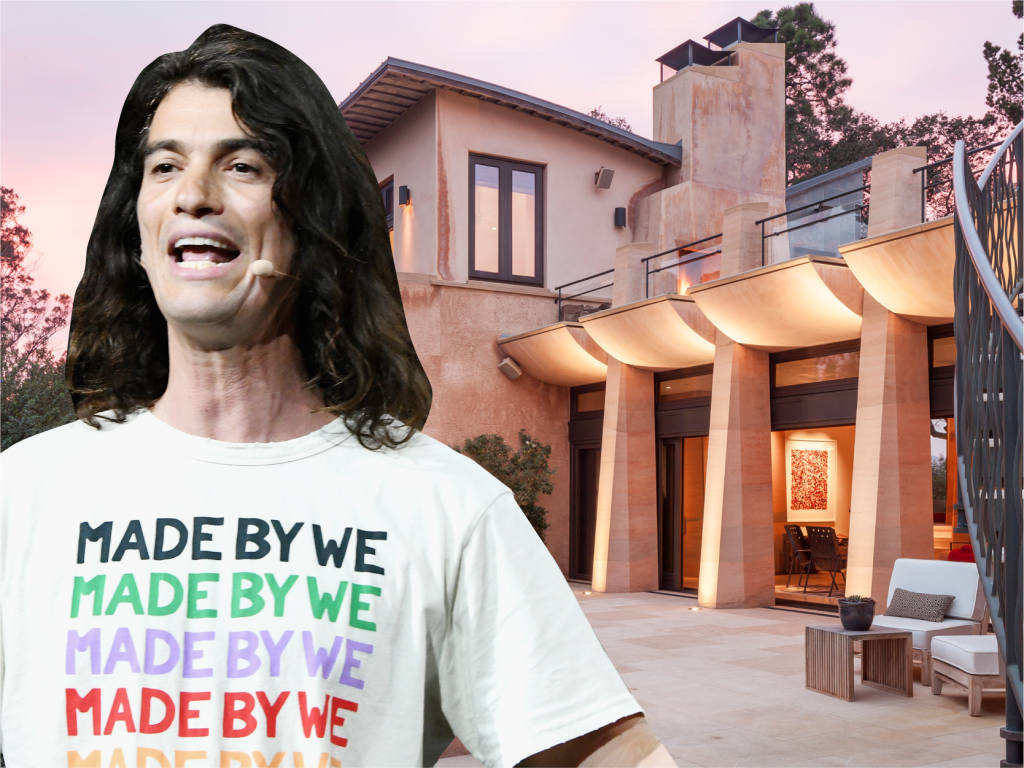

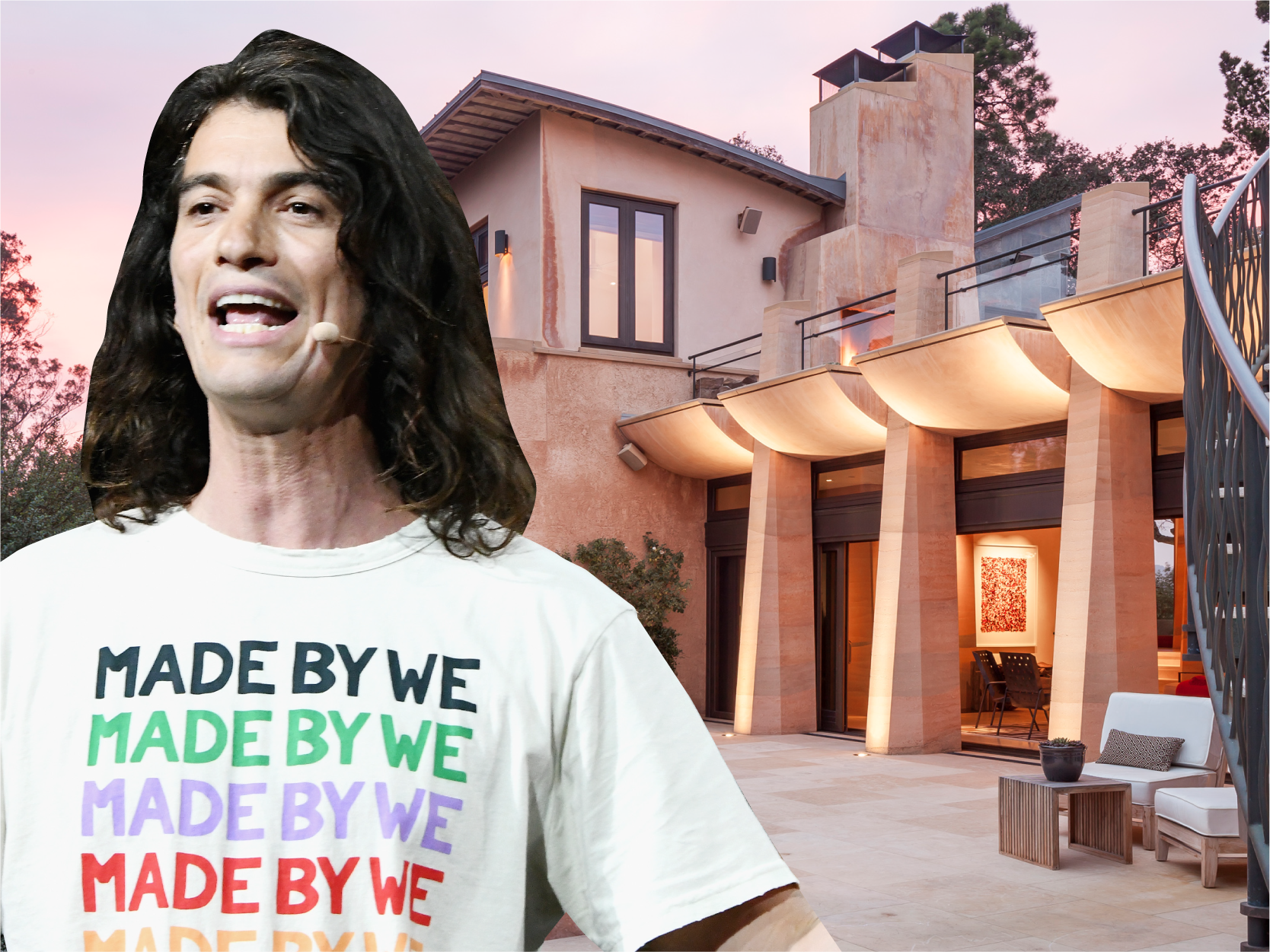

Ousted WeWork founder Adam Neumann received far more money from the company than previously known, a new book says.

Through stock sales and the sum he got for stepping down as CEO, Neumann and We Holdings, an entity he controlled, were paid more than $1 billion in cash while the company lost over $11 billion, according to "The Cult of We: WeWork, Adam Neumann, and the Great Startup Delusion."

Neumann and We Holdings sold roughly $495 million in stock while he was at the helm of the company, one of the largest sums ever withdrawn by the CEO of a US startup before an IPO, the book says.

Previously, Neumann was believed to have "cashed out more than $700 million from the company ahead of its initial public offering through a mix of stock sales and debt," The Wall Street Journal reported in 2019. Axios reported that, of that sum, roughly $300 million came from stock sales.

Neumann used money from six of eight fundraising rounds, including the company's first, for personal use, according to the book. His riches from WeWork bankrolled a lavish lifestyle: Neumann purchased eight homes, including one with a guitar-shaped room, and had an entourage that included a full-time surfing instructor and, at times, three nannies for his five children. In one building, he had so many units that he controlled its condo board.

Neumann, with his wife, Rebekah, sometimes enlisted WeWork staff to take care of the family's personal matters while on the clock for the company. One time, the task at hand was to move a 5G antenna that was near the Neumanns' Manhattan apartment since Rebekah Neumann was concerned about electromagnetism, according to the book.

In negotiations for a deal in which SoftBank would buy most of WeWork, Neumann wanted to include a provision saying he couldn't be removed from his role without penalty unless he committed a violent felony, the book says. When the deal fell through, then-board members Bruce Dunlevie and Steven Langman offered Neumann almost 10 million shares of stock options to take WeWork public. It wasn't enough. Neumann had the company legally reclassified so he and some executives would save big on taxes for their stock packages, according to the book.

On multiple occasions, Neumann created flagrant conflicts of interest by personally taking a stake in buildings in which WeWork leased office space, going against the warnings of the company's board, the book says. In 2016, Neumann and Langman made a deal to start a company called WeWork Property Investors that would buy buildings in which WeWork was leasing.

In 2018, Neumann convinced his board members, who were "growing weary of pushing back," to greenlight a purchase of a $63 million private jet, the book says. During renovations at company headquarters, Neumann had a personal. bathroom, sauna, and ice plunge installed in his office.

In negotiations for his payout to step down, Neumann asked SoftBank to forgive the $1.7 million debt he owed WeWork for things like his personal trips on the private jet and employees' work on personal matters, like moving the 5G antenna, according to the book. SoftBank agreed, and Neumann walked away with a $185 million payout and the ability to sell $1 billion in stock.

Early on, when WeWork precursor Green Desk was sold, Neumann had given his money to co-founder Miguel McKelvey for safe keeping. According to the book, he told McKelvey, "Put it somewhere else because I know I'll spend it if I have access to it."

A spokesperson for WeWork declined to comment when reached by Insider.